Kim Kardashian West gets paid thousands of dollars for a single post on Instagram. And with her experience and influence, people wouldn’t think that she would promote or do any kind of business with sketchy companies. However, Charles Randell, chair of the U.K.’s Financial Conduct Authority, warns social media users of her latest cryptocurrency ad.

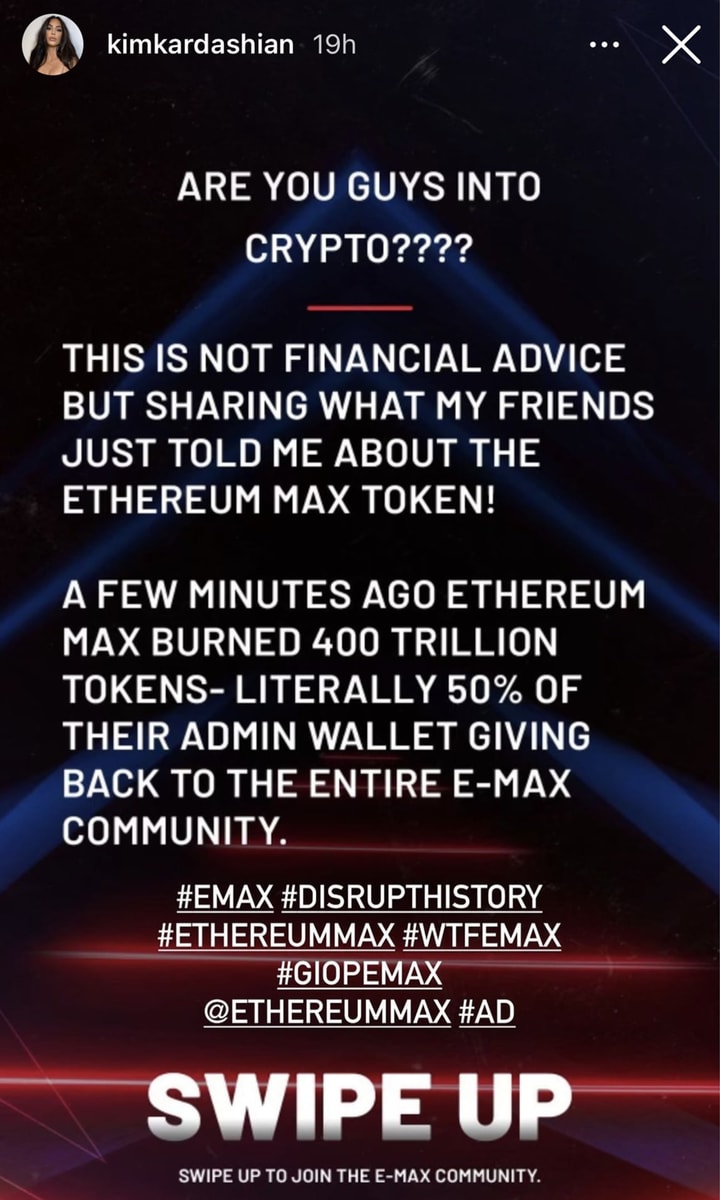

According to Randell, Kim’s paid advertisement of Ethereum Max is a “speculative” cryptocurrency. UK’s financial watchdog said in a speech that Kardashian West had asked her more than 250 million Instagram followers to “speculate on crypto tokens by ‘joining the Ethereum Max Community,’” adding that her post “may have been the financial promotion with the single biggest audience reach in history.”

CNBC informed that although Randell acknowledged that Kardashian announced that it is an ad, as Instagram’s rules state, she did not disclose that the company is built by developers that are yet to be known. “But she didn’t have to disclose that Ethereum Max — not to be confused with Ethereum — was a speculative digital token created a month before by unknown developers — one of the hundreds of such tokens that fill the crypto-exchanges,” Randell said at the Cambridge International Symposium on Economic Crime.

To date, Randell said he is unaware if Ethereum Max is a scam; but he knows how “social media influencers are routinely paid by scammers to help them pump and dump new tokens on the back of pure speculation.”

The publication also revealed that the expert noted that there “are no assets or real-world cash flows underpinning the value of cryptocurrencies,” and that people need to know that even in the case of more established tokens like bitcoin, they have only existed for “a few years,” making it impossible to see a complete market cycle.

“If you buy them, you should be prepared to lose all your money,” Randell stated, highlighting that the FCA does not regulate cryptocurrency tokens, and their hype “generates a powerful fear of missing out from some consumers.”

“There is no shortage of stories of people who have lost savings by being lured into the crypto bubble with delusions of quick riches, sometimes after listening to their favorite influencers, ready to betray their fans’ trust for a fee,” he said.

,type=downsize)